Introduction to Income Tax

Income tax is a crucial aspect of personal and business finances. It is the tax levied on the earnings of individuals, corporations, and other entities. Understanding how income tax works can significantly impact your financial planning and overall economic health. Without a solid grasp of this subject, you may encounter unexpected costs or missed opportunities for savings.

Types of Income Tax

There are generally two types of income tax: progressive and proportional. Progressive income tax means that the rates increase as your income rises, which is designed to impose a higher tax burden on those who can afford it. Proportional income tax maintains a constant tax rate regardless of income level. Different tax systems around the world adopt different approaches to income tax, depending on their economic structures and policies.

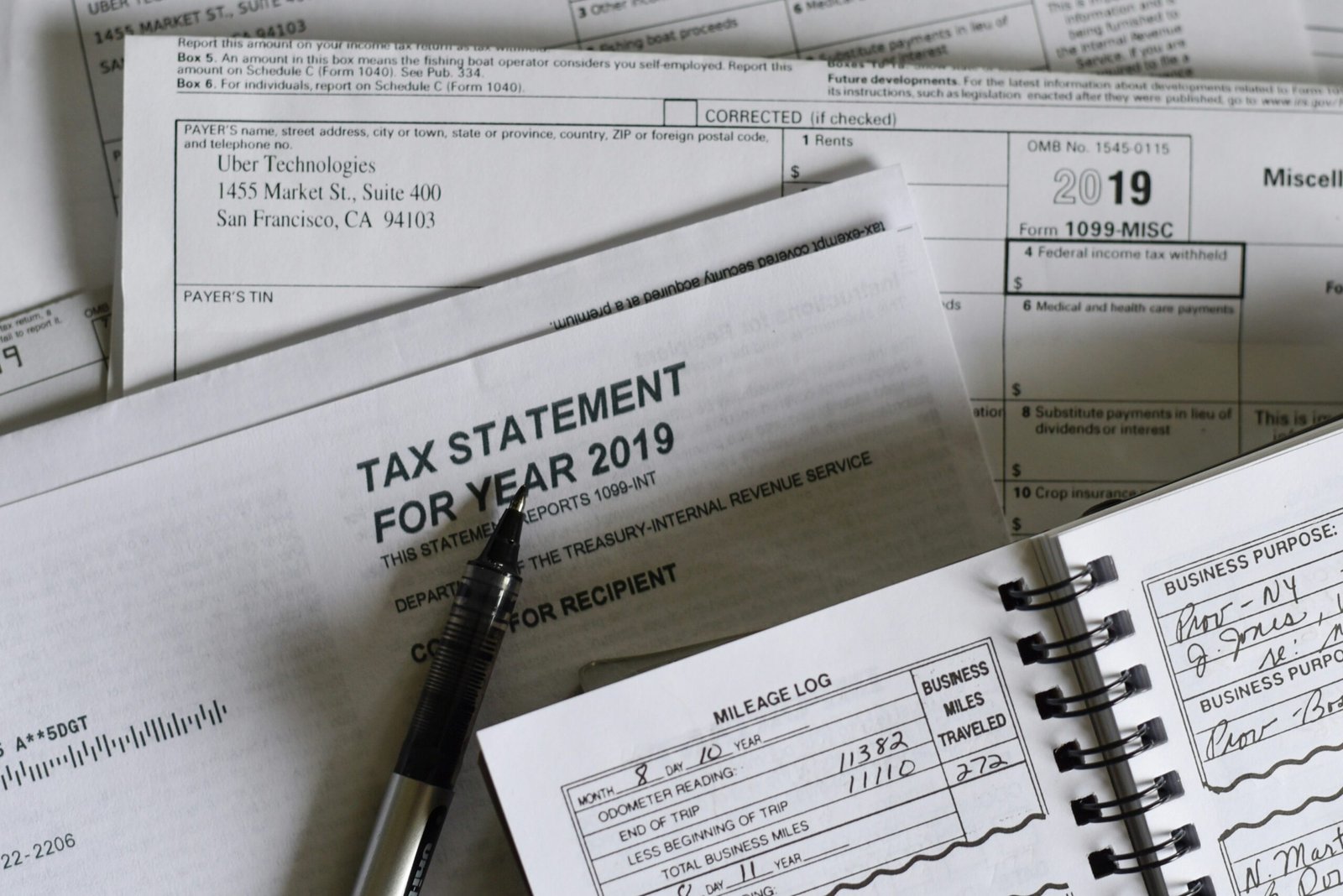

Importance of Filing Income Tax Returns

Filing income tax returns is not just a legal obligation, but it also provides numerous benefits. Timely and accurate tax returns can lead to refunds if you’ve overpaid or qualify for tax credits. Additionally, maintaining a good tax record is crucial for loans, mortgages, and other financial applications. Being aware of key deadlines and the necessary documentation can make the income tax filing process much smoother. Always consult with a tax professional to explore potential deductions and credits that you might qualify for.